Supporting Shoppers Stress

We’ve all been on quite a roller coaster ride since early March of 2020. Immunity, stress, anxiety and weight loss are some of the most talked about health issues since the pandemic rolled in.

The NEXT team was eager to explore the emotional health conditions that have emerged, including stress and anxiety, and whether consumers are truly paying for the products and services to address these health issues.

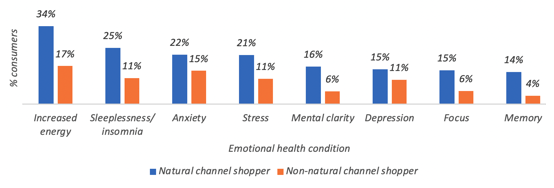

Through a convenience sample survey of 1,000 consumers directionally representative of the U.S. adult population and weighted for age, gender and region (and screened for where they shop – about 23% identified as natural channel shoppers), it’s clear that natural channel shoppers are more inclined to spend money on emotional health needs than non-natural shoppers.

Last week we asked consumers, “Are you currently paying for products or services (e.g., professional guidance, books, supplements) for any of the following health conditions?” The results showed the top conditions natural channel shoppers are spending include: increased energy (34%), insomnia (24%), anxiety (22%), and stress (21%). In total, 57% of natural channel shoppers told us they’re spending some amount of money on the above listed conditions, in addition to mental clarity, depression, focus and memory.

Natural channel shoppers are spending more than non-natural channel shoppers on products and services to manage emotional health conditions

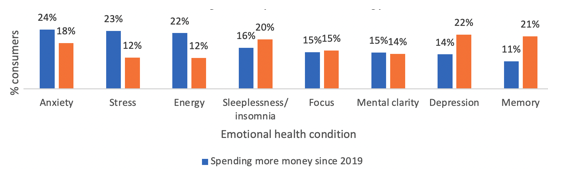

When these same natural channel shoppers were asked which emotional health needs they are spending more money on compared to 2019 (before COVID-19 emerged), anxiety, stress and energy saw the biggest increase in investment.

Natural channel shoppers are spending more on products

and services to manage anxiety, stress and energy

Despite 20% of natural consumers telling us they’re spending less to address sleeplessness vs. 16% who say they are spending more, investment in products that increase energy is high. Is it possible consumers might actually be reaching for energy products and services as a solution to address other conditions like sleeplessness, depression, anxiety and stress, which can result in low energy?

Consumers may have an array of emotional conditions they’re not directly addressing and instead seeking energy products to compensate for their low energy levels. This begs the question: Do brands in the energy space truly know the issues of their consumers? We see an opportunity to listen to these energy-seeking consumers to understand the root cause of their energy needs and develop products to better support those needs.

Eager to learn more about your consumer and their true needs? NEXT has a variety of consumer surveying options, let’s talk!

See you NEXT month!