The trendiest of trends

We at NEXT are trend trackers. We’re experts at seeing trend themes surface across all our touch points – trade shows, digital events, content, interviews – allowing us to identify and track new trends, as well as see trends evolve. Not only can we identify and name those trends but then we can quantify them across various platforms:

- Trends and innovation that surface at natural products trade shows

- Trends representing target companies in the investment space

- Trends that consumers seek, to name a few

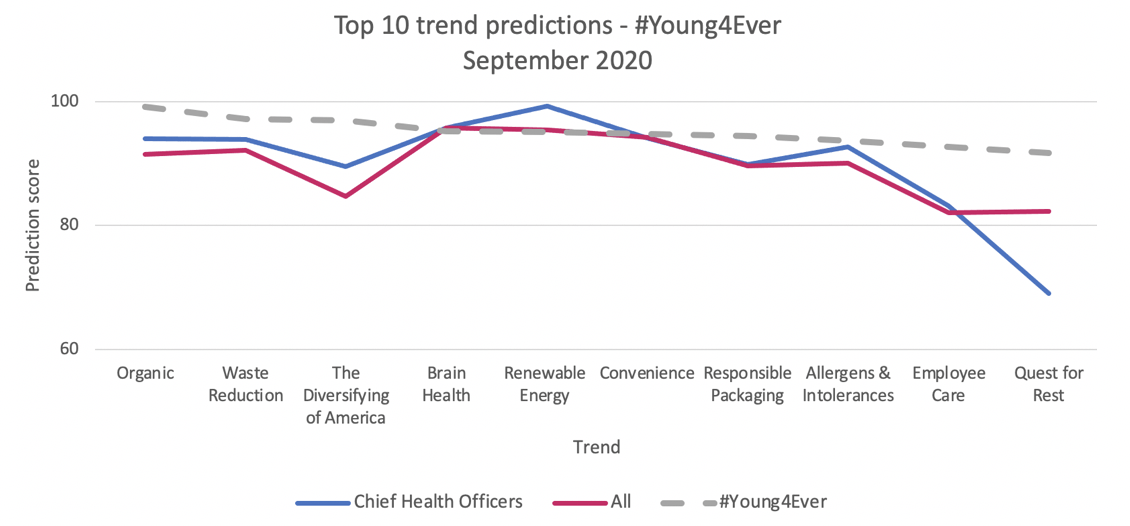

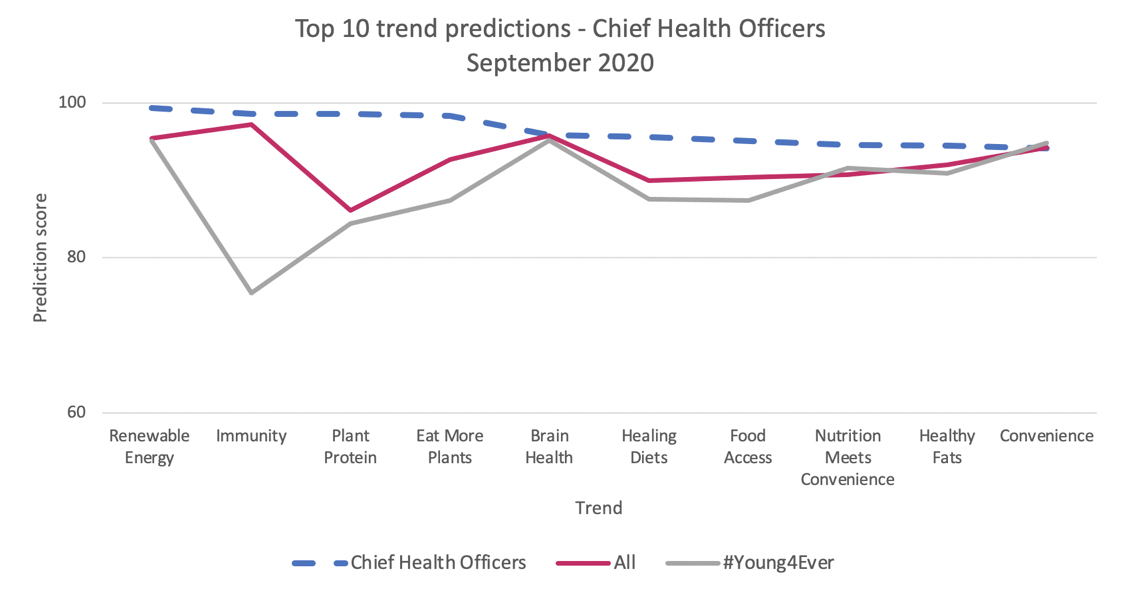

The trends data we’re sharing today is gleaned from the consumer perspective based on a survey NEXT conducted in September, which asked 1,000 consumers – representative of the U.S. adult population – to evaluate 40 of the top trends shaping the natural products industry and assess which trends they think are most likely to succeed in the next twelve months. We cut the data by consumer segment to see the trend prediction perspective from the view of two of our natural consumer personas:

#Young4Ever

This natural shopper segment slants younger (millennial), single, and male, and is a trailblazer when it comes to trying new products to meet their health goals.

Chief Health Officer

The other core natural shopper counterpart, skews toward millennial women with young families, willing to pay more for healthy and natural products.

The #Young4Ever natural shopper foresees more socially and environmentally-focused trends (organic, waste reduction, diversifying of America, responsible packaging) captivating consumers over the next year. Meanwhile…

The Chief Health Officer predicts more health-centric trends (immunity, brain health, healthy fats, nutrition meets convenience) will succeed in capturing consumers’ attention.

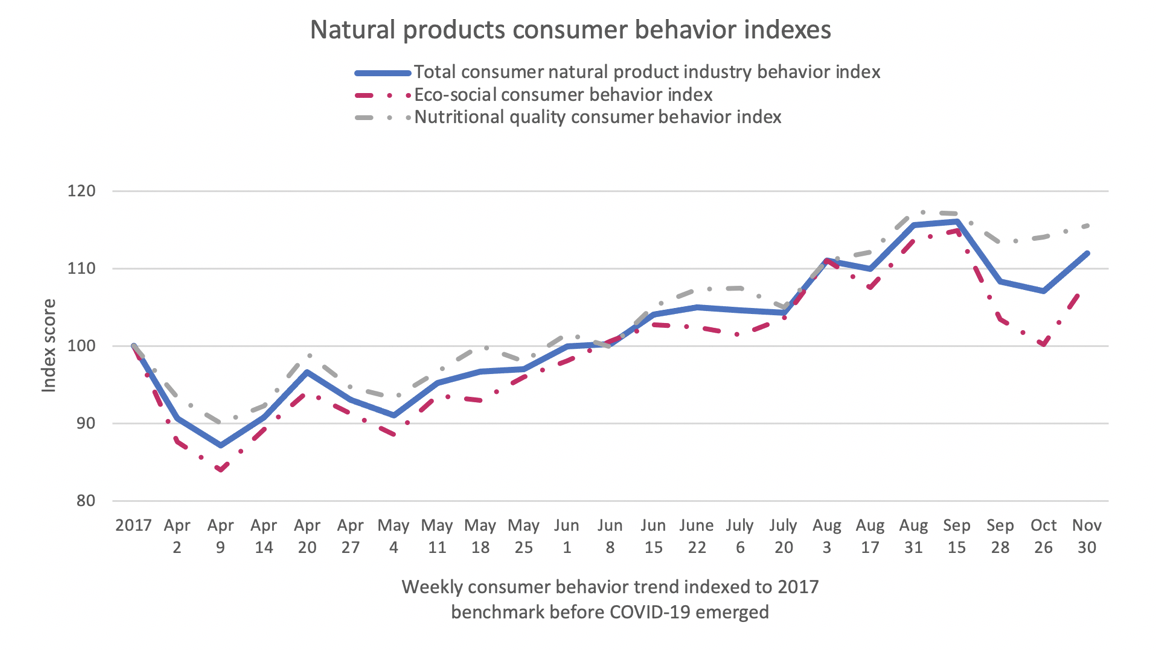

It’s clear that both eco-social and nutritional wellbeing are top of mind with consumers. Since COVID sent us all indoors, NEXT has been tracking how consumers perceive their changing behaviors by asking them on a weekly and monthly basis how strongly they align with core eco-social or nutritional quality attributes when making purchasing decisions at the grocery store.

In April and May, consumer alignment with core natural shopping behaviors dipped away from the “normal” pre-COVID benchmark. It was an unsettling time with empty shelves and hoarding of food and supplies. After that initial shift in life however, consumers have shown a stronger alignment with buying products based on eco-social principles or prioritizing products that are clean and nutrient dense – as the natural products consumer behavior index reflects. Since May and June, consumers are indicating that they are higher than the benchmark. As of November 30, 2020, alignment is 8 points above eco-social behaviors and 16 points above nutritional quality behaviors when compared to pre-COVID “normal.”

Your brand’s positioning depends on your target consumer, and identifying which trends to focus on depends on which trends are showing the most momentum with your target consumer. NEXT tracks trends from the perspective of innovators, investors, and consumers. Combining these three sources generates targeted insights that will resonate with your customers and inform your brand’s strategy. Want to learn more? Let’s talk!

Eager for even more insights? Check out the latest Natural Products Industry Health Monitor: 2021 New Year’s resolutions impacted by 2020.